Introduction

In the thin-margin, high-velocity world of global dropshipping, your payment gateway is more than just a tool to collect money—it is the engine of your cash flow. For scaling business owners like you, the difference between a profitable month and a cash crunch often comes down to transaction fees, payout schedules, and the dreaded risk of account holds.

Many dropshippers hesitate to go “all in” on the platform’s native gateway due to lingering rumors about “high-risk” business bans or confusion over international currency fees. However, relying solely on third-party gateways often means paying a “penalty fee” to Shopify that silently eats away at your bottom line.

This guide provides a deep dive into Shopify Payment, analyzing fees, international capabilities, and—crucially—how securing your supply chain with professional logistics is the best way to secure your merchant account.

What is Shopify Payments and Why Should Dropshippers Use It?

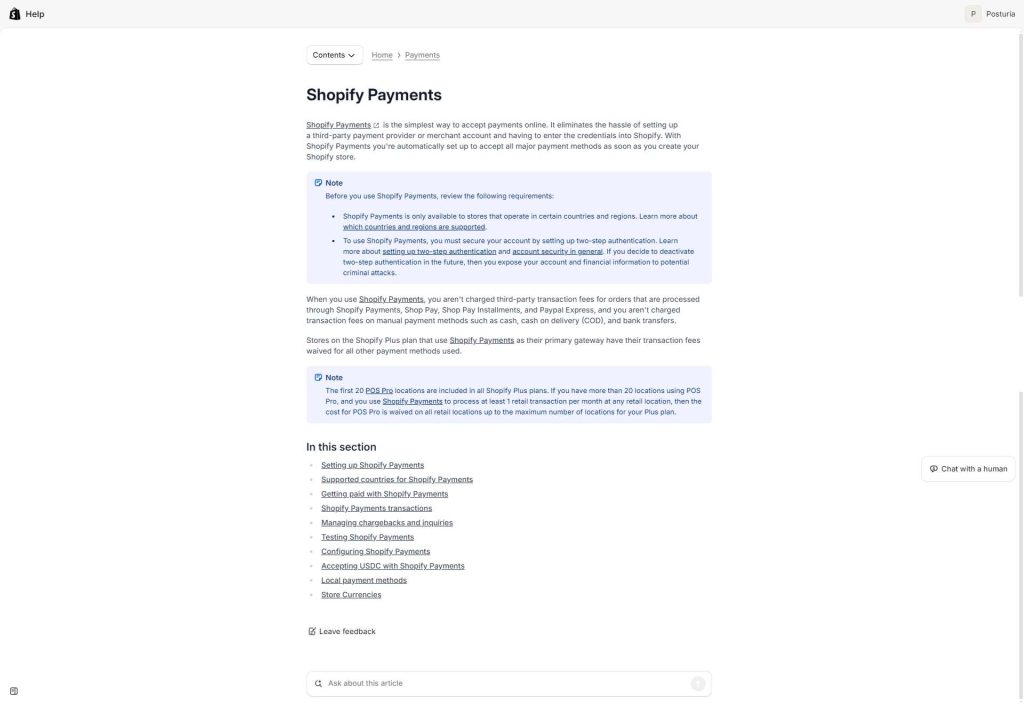

Shopify Payments is the platform’s integrated payment processing solution, powered by Stripe but tailored specifically for the Shopify ecosystem. It allows you to manage orders, inventory, and payments from a single dashboard, eliminating the friction of toggling between multiple provider screens. If you’re still new to the platform, start with our guide on what Shopify is and how it works before optimizing your payment stack.

The “No Transaction Fee” Advantage

For dropshippers operating on tight margins, the primary argument for using this integrated solution is cost avoidance.

If you do not enable the default provider and use a third-party gateway (like PayPal Express Checkout alone) as your primary processor, Shopify charges an additional transaction fee on every sale. This is on top of the processing fee charged by the third-party provider.

- Basic Plan: +2.0% fee

- Shopify Plan: +1.0% fee

- Advanced Plan: +0.5% fee

The Margin Impact: Imagine your store generates $50,000 in monthly revenue on the Basic plan. If you do not use the internal processor, you are paying an extra $1,000 per month solely in transaction fees to Shopify. Enabling Activating the service waives this fee instantly, adding that capital back to your profit margin.

Shopify’s own official breakdown of Shopify Payments and third-party transaction fees confirms how these extra charges stack when you don’t use the native gateway.

Streamlined Operations for High-Volume Sellers

When scaling a dropshipping business from 10 to 100+ orders a day, financial reconciliation becomes a major bottleneck. Shopify Payment provides a unified view of your financial health. With real-time tracking of payouts and chargebacks directly in your admin, it becomes significantly easier to track cash flow against your supplier invoices from Runtoagent, ensuring your procurement cycle never stalls.

The Real Cost: Shopify Payment Fees Explained

To make an informed decision, you must look beyond the headline rates and understand the Total Cost of Ownership (TCO). Fees vary significantly based on your plan and your customer’s location.

Domestic Transaction Fees

These are the fees charged when a customer in your store’s primary country buys from you. Rates improve as you upgrade your Shopify subscription.

| Shopify Plan | Online Credit Card Rate | In-Person Rate | Third-Party Fee (If SP not used) | Ideal Monthly Revenue |

|---|---|---|---|---|

| Basic | 2.9% + 30¢ | 2.6% + 10¢ | 2.0% | < $15k |

| Shopify | 2.6% + 30¢ | 2.5% + 10¢ | 1.0% | $15k – $120k |

| Advanced | 2.4% + 30¢ | 2.4% + 10¢ | 0.5% | > $120k |

For a full Shopify Pricing 2025 plan comparison with updated transaction fees, see our dedicated breakdown. Strategic Insight: Do the math. If your monthly revenue exceeds ~$15,000, the savings from the lower rate on the “Shopify” plan (2.6% vs 2.9%, see Shopify’s credit card processing fee ranges by plan) usually outweigh the higher monthly subscription cost.

You can always double-check your exact domestic and ‘Rest of World’ rates inside the Shopify Payments payout fees and rate table.

The Hidden Cost: International & Currency Conversion Fees

For the global dropshipper targeting markets like the USA, Germany, and Australia simultaneously, international fees are a critical consideration.

- Cross-Border Fees: Shopify typically charges an additional 1% fee on transactions made by cards issued outside your store’s home country.

- Currency Conversion Fees: If you sell in EUR but your payout bank account is in USD, Shopify charges a currency conversion fee (typically 1.5% to 2%) on the exchange rate to convert the funds before depositing them.

For specific percentages by region, Shopify’s own guide to foreign transaction fees is the best reference point.

Runtoagent Expert View: While these fees seem high, they are often comparable to or lower than PayPal’s cross-border fees (which can reach 4%+). To protect your margins, you must factor these costs into your product pricing strategy. This is where a sourcing partner adds value: Runtoagent helps clients negotiate lower product costs with Chinese factories, often saving 5-10% on procurement, which effectively offsets these inevitable payment processing expenses.

Chargeback Fees

If a customer disputes a charge, the payment facilitator levies a fee (typically $15 USD, £10 GBP, etc.). If you win the dispute, this fee is refunded. If you lose, the fee is lost along with the transaction amount. Preventing chargebacks through rigorous Quality Control (QC) is infinitely cheaper than fighting them.

Global Expansion: Using Shopify Payments for International Sales

Scaling globally requires more than just running ads in different countries; it requires a localized checkout experience that builds trust.

Multi-Currency Selling

The native system allows you to sell in 130+ currencies. A customer in Paris sees prices in Euros, while a customer in Sydney sees Australian Dollars.

- Why it matters: Displaying local currencies can increase conversion rates by up to 20%.

- Implementation: With Shopify Markets, you can automate this process, ensuring the exchange rate is calculated in real-time (protecting you from currency fluctuation risks).

This is exactly how Shopify Payments handles selling and getting paid in different currencies at the payout level.

Local Payment Methods

Trust is the currency of e-commerce. In many European markets, credit cards are not the preferred payment method. This gateway integrates local options that are vital for conversion:

- Netherlands: iDEAL

- Germany: Sofort / Klarna

- Belgium: Bancontact

- Poland: Przelewy24

The Logistics Connection: Offering local payment methods sets an expectation of a local experience. If a German customer pays via Sofort but waits 30 days for an ePacket delivery, you risk a dispute. By utilizing Runtoagent’s global fulfillment network, you can pair these localized payment methods with localized shipping. For example, utilizing our dedicated Europe shipping line (4-10 days) aligns the delivery speed with the premium checkout experience, creating a cohesive brand promise.

The “High Risk” Myth: Is Shopify Payments Safe for Dropshipping?

This is the most common question we receive from new merchants: “Will Shopify Payments ban me because I am dropshipping?”

The Reality: Their risk team does not ban dropshipping. They ban high-risk behavior. The platform’s Terms of Service prohibit businesses that pose a financial risk, which usually manifests as high chargeback rates or fraudulent activity.

Why Accounts Get Held (The Supply Chain Connection)

Payment processors use algorithms to detect risk. Your account is likely to be flagged if:

- Disputes Spike: Customers file “Item Not Received” chargebacks because shipping took 30 days.

- Quality Fails: Customers file “Not as Described” claims because the product looks cheap compared to the ad.

- Tracking is Missing: You capture payment but don’t upload tracking numbers for days.

How to Secure Your Account with Runtoagent

The health of your payment gateway is directly tied to the health of your supply chain. Here is how professional logistics mitigates financial risk and keeps your merchant account account green:

- 4-10 Day Global Shipping: By moving away from slow AliExpress shipping to Runtoagent’s dedicated lines, products arrive before the customer gets anxious. This drastically reduces “Item Not Received” disputes.

- 3-Point Quality Control (QC): We inspect products upon arrival at our warehouse. If a supplier sends a defective batch, we catch it before it ships. This eliminates “Not as Described” chargebacks that trigger payment reviews.

- Proof of Fulfillment: The processor often releases holds once they see valid tracking. Runtoagent’s IT system integrates with your Shopify store to upload valid, traceable tracking numbers automatically and instantly.

Pro Tip: If Shopify requests documents to verify your business, having professional invoices and a contract from a sourcing agent like Runtoagent is far more credible than screenshots from random AliExpress vendors.

Shopify Payments vs. The Alternatives

Should you rely 100% on the built-in option? For most global sellers, the answer is a strategic mix tailored to your target market.

If you’re still deciding whether the model itself is right for you, read Is Dropshipping on Shopify Worth It in 2025? for a full profit analysis.

Shopify Payments vs. PayPal

- PayPal: Highly trusted by buyers, increasing conversion on “cold” traffic. However, PayPal is known for aggressively holding funds (rolling reserves of up to 30%) if sales scale too quickly.

- The native option: Lower fees, integrated dashboard, better for cash flow, and generally less aggressive with random holds if tracking info is present.

- Verdict: Use Both. Offer PayPal to capture trust-sensitive buyers, but prioritize Shopify Payments to maximize margins.

Shopify Payments vs. Stripe

- The Context: Shopify Payment is white-labeled Stripe. In countries where the service is available, you generally cannot add a standalone Stripe account to your store.

- The Exception: If you are in a country where Shopify Payments is not supported, opening a US LLC or UK Ltd company to access Stripe or Shopify Payments is a common strategy for advanced dropshippers.

For a broader look at Shopify checkout and payment options beyond just the gateway choice, see our beginner-friendly breakdown.

Comparison Matrix

| Feature | Shopify Payments | PayPal | Third-Party (e.g., Authorize.net) |

|---|---|---|---|

| Transaction Fee | 0% | 0% (but Shopify charges +0.5-2%) | 0% (but Shopify charges +0.5-2%) |

| Setup Difficulty | Instant | Easy | Moderate/Hard |

| Chargeback Fee | ~$15 | ~$20 | Varies |

| Payout Speed | 2-4 Days | Instant (to PayPal balance) | Varies |

| Global Reach | Excellent | Excellent | Varies |

Operational Workflow: Integrating Payments with Supply Chain

Managing the flow of money is just as important as managing the flow of goods. A breakage in this cycle can stop your ads and shipping simultaneously.

The Cash Flow Gap

In dropshipping, you often receive money from the customer after you need to pay your supplier.

- Customer orders (Day 0).

- You pay Runtoagent for product + shipping (Day 0-1).

- The gateway releases funds to your bank (Day 2-4).

Strategy for Scaling: To bridge this gap without stalling orders, successful sellers use Shopify Balance (where available) to receive funds as fast as one business day. Furthermore, establishing a consistent order history with Runtoagent allows for streamlined billing processes. We provide transparent invoices that are compatible with business financing tools, ensuring your fulfillment never pauses while waiting for bank transfers.

IT Systems Integration

Mature sellers do not manually check spreadsheets. Runtoagent’s IT support allows for ERP integration. This means your financial data from your payment processor can be reconciled against shipping costs and product costs automatically, giving you a real-time view of your net profit per unit. This level of data clarity is essential for spotting “profit leaks” caused by currency conversion or fluctuating shipping rates.

How to Set Up Shopify Payment for Dropshipping (Step-by-Step)

Setting up is straightforward, but accuracy is non-negotiable to prevent verification holds.

- Business Details: Ensure your business name and address in Shopify match your bank account and business registration documents perfectly. Even a small typo can trigger an identity review.

- Banking Information: Use a dedicated business bank account. Mixing personal and business funds is a red flag for auditors.

- Statement Descriptor: This is the name that appears on your customer’s bank statement. Crucial Tip: Make sure this matches your store name or domain name. If a customer sees a charge from “LLC Holdings Inc” instead of “MyCoolGadgets.com,” they may not recognize it and file a “Friendly Fraud” chargeback.

- Fraud Filters: Configure your AVS (Address Verification System) and CVV filters in Shopify settings to auto-decline suspicious orders. It is better to lose a sale than to suffer a chargeback.

You can see these steps in context inside our Shopify website setup and payment gateway configuration guide.

FAQ: Common Questions from Global Sellers

Q: Is Shopify Payments available in my country? A: Shopify Payments is available in major markets including the US, UK, Canada, Australia, and many EU countries. If you are located in an unsupported region, consider forming a US LLC or UK Ltd to gain access. Once eligibility is clear, follow our step-by-step guide to dropshipping on Shopify to configure payments, shipping, and apps the right way.

Q: How long does the Shopify Payments payout schedule take? A: Payouts depend on your country. In the US, Canada, and Australia, it is typically 2 business days. In other regions, it can take up to 4 business days.

Q: What happens if I get a chargeback? A: The disputed amount plus a ~$15 fee is withdrawn from your account immediately. You must submit evidence to win the dispute. Runtoagent provides clients with valid tracking numbers and proof of delivery instantly to help win these cases.

Q: Can I sell in USD but get paid in EUR? A: Yes. Shopify handles the currency conversion automatically, depositing funds into your bank account in your local currency (minus the conversion fee).

Q: Does Runtoagent help with Shopify Payments disputes? A: While we cannot interact with Shopify on your behalf, we provide the “ammunition” you need to win: shipping manifests, tracking logs, and photos of the product from our QC process to prove the item was shipped correctly and in good condition.

Conclusion: Secure Your Payments by Securing Your Supply Chain

Shopify Payment is arguably the most powerful financial tool for global dropshippers. It simplifies operations, opens global markets with multi-currency support, and most importantly, protects your profit margins by eliminating penalty fees.

However, a payment gateway is only as secure as the business behind it. The number one cause of payment holds and bans is not the dropshipping model itself—it is supply chain failure.

If you want to enjoy the financial benefits of using the default gateway without the risk of account holds, you must ensure your customers receive high-quality products fast.

If you want to enjoy the financial benefits of using the default gateway without the risk of account holds, you must ensure your customers receive high-quality products fast.

Ready to stabilize your business? Partner with Runtoagent for sourcing, quality control, and 4-10 day global shipping. We handle the logistics so you can focus on scaling your revenue.

If you’re still comparing partners, our guide on how to find a reliable dropshipping agent walks through vetting criteria step by step.